Westpac NZ is cutting all its fixed special home loan rates, giving it the joint lowest advertised rates of the five major banks on terms from 6 month to 3 years, and the outright lowest on its 4-and-5-year terms.

It’s the fourth time Westpac has cut its fixed rates since the start of July. On Wednesday it also passed on the official cash rate reduction to some customers.

The bank is also lowering some of its term deposit rates. All changes are effective Monday 19 August.

Westpac NZ General Manager of Product, Sustainability and Marketing Sarah Hearn says the bank continues to look for opportunities to pass on wholesale rate drops to customers in a highly-competitive market.

“Today’s changes mean our popular 1-year advertised special home loan rate has fallen by 0.55% p.a. over the past six weeks, delivering real savings to many homeowners,” Ms Hearn says.

“At the same time, we know some savings customers will be watching falling interest rates closely.

“We strongly encourage customers, whether borrowers or savers, to contact their bank as soon as they can, if they have any worries about their finances.”

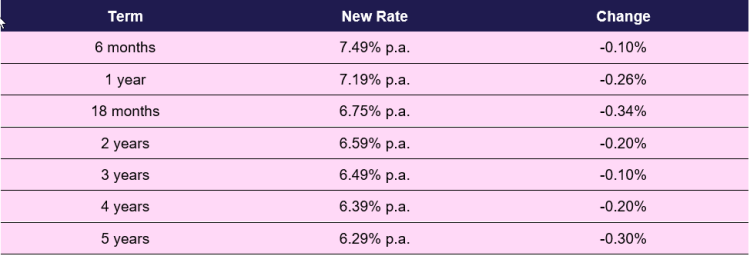

Fixed home loan rates – Special – effective 19 August 2024

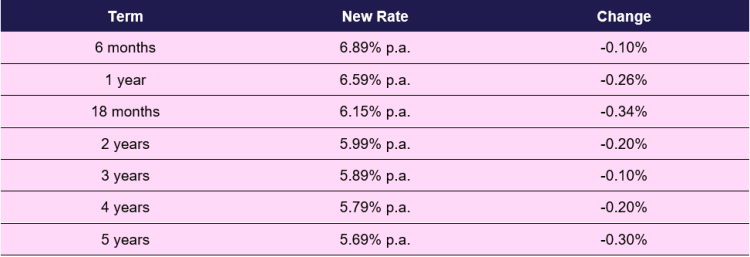

Fixed home loan rates – Standard – effective 19 August 2024