Westpac New Zealand (Westpac NZ)[i] has reported a net profit of $963 million for the 12 months ended 30 September 2023[ii] and is well positioned to support customers through the current challenging economic conditions.

Excluding Notable Items, such as the sale of Westpac Life in the 2022 financial year, which was not repeated, net profit was down 7%, compared with the same period last year.

Westpac NZ Chief Executive Catherine McGrath says the bank has invested heavily in helping customers through difficult times and strengthening its core business, and heads into the next 12 months with positive momentum.

“Throughout the year we’ve stepped up to help New Zealanders through a range of immediate challenges and set them up for the longer term,” Ms McGrath says. “Following this year’s severe weather events, we provided $3.9 million in direct support to customers and to the community and iwi groups who were providing relief.

“We continue to lead the way in helping customers reduce their environmental impact and costs. In the past year we relaunched our Greater Choices sustainable home loan product[iii] – which includes New Zealand’s first interest-free EV loan – as well as launching New Zealand’s first ever whole-of-farm Sustainable Farm Loan and a new Sustainable Business Loan[iv].

“Fraud and scams are impacting many New Zealanders’ lives. Recently, we became the first New Zealand bank to partner with Biocatch, a global cybersecurity company that analyses customers’ online behaviour to help detect unusual activities and protect them against financial crime.

“With housing affordability still a hurdle, we helped 5,565 Kiwis into their first home – a 7% increase on the previous year – with a range of innovative products and solutions, such as helping bridge the gap between renters and owners with our support of shared equity and leasehold models.

“By working together with customers through good times and bad, our goal is to help them navigate ongoing cost-of-living pressures. During the low interest rate period of two to three years ago, many homeowners built up a savings buffer and most now remain well placed to manage interest rate rises.”

Key financials

(All comparisons are for the 12 months ended 30 September 2023 versus the same period last year)

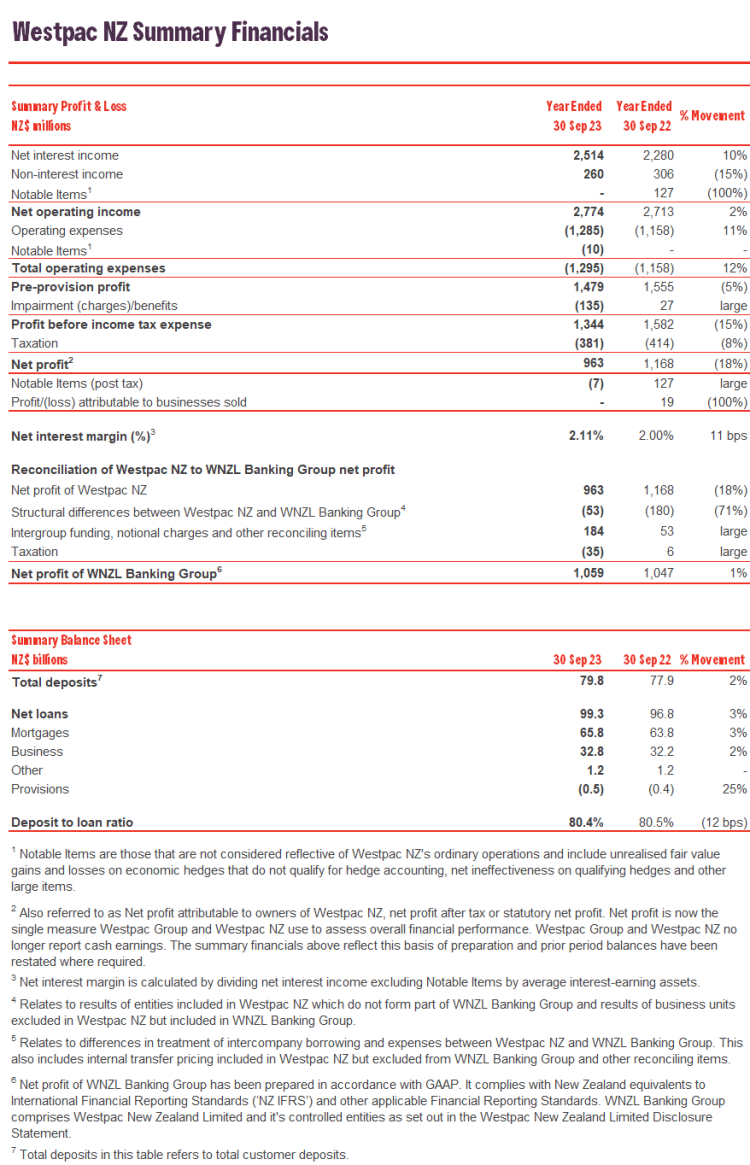

- Net profit of $963 million, down 18% (down 7% excluding Notable Items).

- Pre-provision profit of $1,479 million, down 5% (up 4% excluding Notable Items).

- Net operating income of $2,774 million, up 2% (up 7% excluding Notable Items).

- Operating expenses of $1,295 million, up 12% (up 11% excluding Notable Items).

- Net impairment charge of $135 million, compared with an impairment benefit of $27 million in the previous period.

- Net interest margin 2.11%, up 11 basis points excluding Notable Items.

- ³Ô¹ÏÍøÕ¾ lending up 3% to $65.8 billion, Business lending up 2% to $32.8 billion, Deposits up 2% to $79.8 billion.

Investing in Aotearoa

Ms McGrath says a significant amount of work has been done to set Westpac up to better support customers in a changing banking landscape. It has invested heavily in its technology resilience, with a 50% reduction in higher priority technology-related incidents from the first half of the year to the second.

The bank also continues to streamline internal processes to enable its teams to help customers more quickly and efficiently, and recently made it easier for eligible new bank customers to refinance home loans or consumer lending with Westpac at the same or a reduced level of lending.

“Our business has a presence in communities across the country. We’ve onshored some of our teams, retained one of the largest branch footprints of any New Zealand bank and are moving our nearly 500-strong Wellington-based team into a new corporate office next year,” Ms McGrath says.

“This year our tax expense is $381 million, placing us as one of the largest taxpayers in the country, and nearly 21,000 New Zealand-based shareholders will receive a dividend from Westpac Banking Corporation.”

The bank has completed its programme of work to meet the new BS11 obligations to the RBNZ, as well as required improvements to its risk governance and liquidity risk management.

“We were also delighted that we were re-appointed as the Government’s banking partner in July, providing transactional services to the Crown through to 2027[v]. This comes with huge responsibility, processing upwards of 90 million transactions a year, and we’ll keep working to help the Government deliver the services Kiwis need, as smoothly as possible,” Ms McGrath says.

The bank doubled its employee volunteer leave to two days a year, and staff logged more than 24,000 hours working on community projects around the country.

“The bottom line is we’re investing in our business and in New Zealand’s future.”

New products to future-proof homes, farms and businesses

Ms McGrath says severe weather and climate-related impacts continue to be a key concern for customers and stakeholders and Westpac was committed to helping Kiwis take action on these issues.

Westpac has lent $1.0 billion through its Sustainable Farm Loan and $41 million through its Sustainable Business Loan since their launch in June. The bank had lent $110 million through its Greater Choices home loan product – which offers up to $50,000 interest-free lending on a range of energy efficient home improvements, as well as EV purchases – and doubled its lending goal to $200 million.

“EVs aren’t just better for the environment – they can really help boost families’ bottom line at a time when fuel prices continue to rise,” Ms McGrath says.

Westpac has enabled $11.7 billion in sustainable finance to date – surpassing its $10 billion target two years ahead of time.

The bank also launched the Westpac Watercare Project with NZ Landcare Trust – annual grants which award $10,000 each to six catchment groups around the country to improve their local waterways[vi].

“This partnership allows our people to work together with passionate locals on conservation projects that will help bring direct benefits to their community”, Ms McGrath says.

Supporting customers in challenging times

In the past six months, the bank has reached out to more than 88,000 customers who were due to roll on to significantly higher fixed home loan rates to help them understand their options.

“We’ve also followed up with phone calls to more than 9,000 customers who we’ve identified as most at risk of financial stress, and we’ve expanded our Extra Care team to provide more proactive support,” Ms McGrath says.

“Hardship levels remain low and the number of homeowners behind on repayments has reduced over the past six months.”

Supporting greater access to bank accounts

The bank is also calling for greater industry collaboration around helping improve New Zealanders’ access to banking services. In April it published the Westpac NZ Access to Banking in Aotearoa Report, outlining why many people struggle to obtain a bank account.

“It’s hard to participate in the economy without a bank account and we’d like to see every New Zealander have access to one. This is an area where we’re keen to work together on making banking more accessible,” Ms McGrath says.

Combatting fraud and scams

Fraud and scams continue to be a top concern for customers. The bank is upgrading its analytics and rules-based fraud monitoring, and its integration of biometrics software through Biocatch will help it to detect unusual customer behaviour online that could indicate a customer had been scammed.

“For example, if a customer is tricked into divulging their account login details, the new technology will help us identify and block attempts by cyber criminals to take over their account,” Ms McGrath says.

“However, scammers adapt quickly to new customer safeguards, which is another reason why the increased collaboration between banks, telecommunications companies, police and other agencies is so important.”

Along with other banks, Westpac helped fund You’ve Been Scammed by Nigel Latta, a four-part documentary aimed at helping bank customers avoid falling victim to financial crime.

Economic outlook

Ms McGrath says New Zealand is heading into a difficult phase of the economic cycle, but remains well-positioned compared to other economies.

“Last week our economists released their Quarterly Economic Overview showing subdued growth likely throughout 2024, with uncertainty over higher long-term interest rates and weakness in our key trading partners, most notably China,” Ms McGrath says.

“However, there are causes for optimism as well. Unemployment remains low, wage growth fairly high and tourism numbers continue to recover. In addition, strong net migration is adding to our labour force and boosting demand, including in the housing market.

“Overall, it’s a mixed bag, but there are lots of reasons to remain optimistic for our customers and Aotearoa New Zealand as a whole.”

[i] Westpac NZ is a segment of the Westpac Banking Corporation Group (Westpac Group). Westpac NZ includes, but is not limited to, Westpac New Zealand Limited, BT Funds Management (NZ) Limited and WBC (New Zealand branch). The financial results of the Westpac New Zealand Limited Banking Group (WNZL Banking Group) will be available in the Westpac New Zealand Limited Disclosure Statement, with a reconciliation between the two results also provided in the Westpac NZ Summary Financials section of this media release.

[ii] Also referred to as Net profit attributable to owners of Westpac NZ, net profit after tax or statutory net profit. Net profit is now the single measure Westpac Group and Westpac NZ use to assess overall financial performance. Westpac Group and Westpac NZ no longer report cash earnings. The summary financials above reflect this basis of preparation and prior period balances have been restated where required.

[iii] https://www.westpac.co.nz/about-us/media/interest-free-lending-on-evs-as-westpac-nz-unveils-greater-choices-loan/

[iv] https://www.westpac.co.nz/about-us/media/westpac-nz-launches-sustainable-farm-loan-and-sustainable-business-loan/

[v] https://www.westpac.co.nz/about-us/media/westpac-nz-pleased-to-extend-its-banking-partnership-with-nz-government/