Deeming is used to estimate the amount of income you earn on your financial assets. This income estimate is then used to determine your eligibility for the pension and eligibility for other support from Centrelink, such as the Commonwealth Seniors Health Card.

When both sides of politics agreed to put in place a freeze on deeming rates at the last election, they could not have foreseen that interest rates would rise rapidly from historic lows.

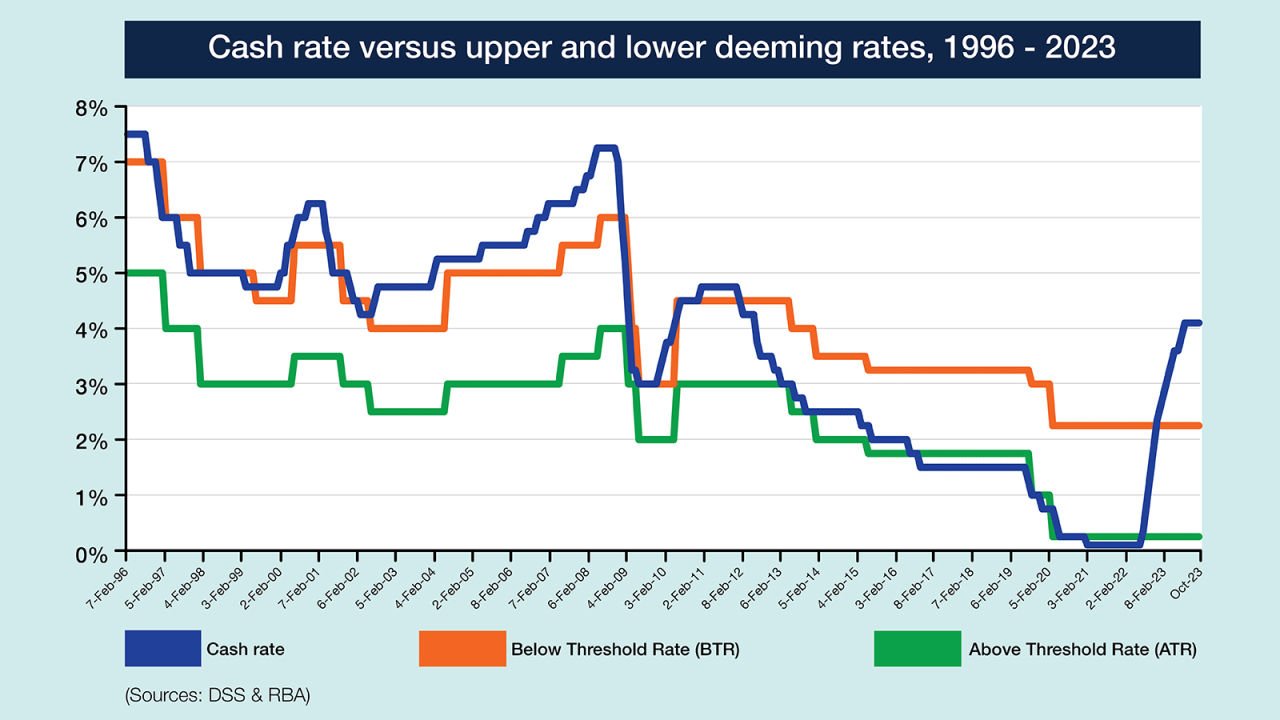

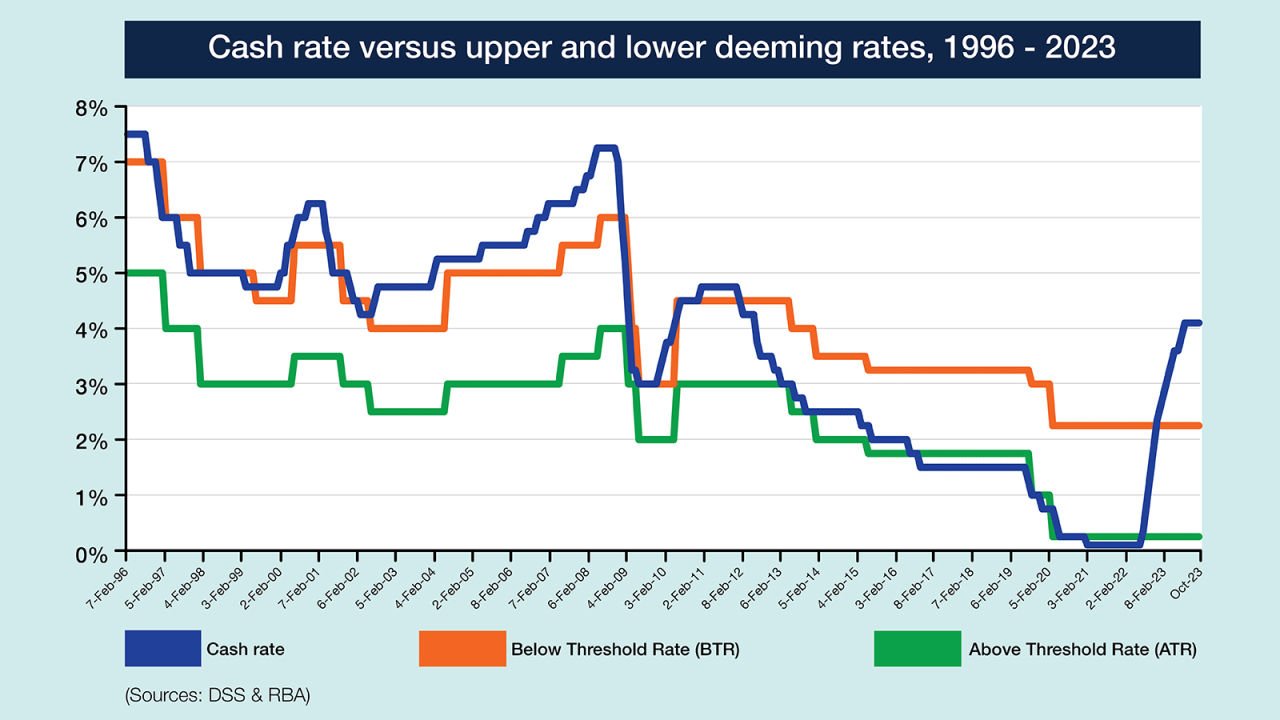

The cash rate increased from 0.1% in the year leading up to the last federal election in 2022 to over 4.35% in November 2023 (see our graph below).

As the graph below shows, deeming rates are now much lower than the cash rate, to the benefit of older Australians.

Pensioners who have their pension amount determined by the income test are benefitting greatly from low deeming rates because they get more in their pocket than if deeming rates were not frozen and tracked up with the cash rate.

The million-dollar question is: What is a fair deeming rate when the freeze ends next year?

If you receive a part-rate Age Pension or have a Commonwealth Seniors Health Card (CSHC) from the Department of Human Services, you should understand how deeming affects you.

Deeming is applied to financial assets at a set rate. This calculation assumes the amount of income these assets earn, regardless of their actual return. Centrelink uses this income estimate to determine your payment amount (in combination with real income). It is also used to assess if a self-funded retiree is eligible for a CSHC.

Deeming is used as a more stable means of estimating income for the income test (it keeps your pension payment steady, so it doesn’t fluctuate as the performance of your financial assets wax and wane). It also provides an incentive to invest in different products without worrying how this affects your pension payment.

Currently, the deeming rate for a single person is 0.25% for every dollar of assets below $60,400, with financial assets above $60,400 deemed as earning 2.25% (for a couple, the threshold is $100,200).

Offering a lower rate for assets below the lower threshold is important because it allows you to have a portion of your financial assets in liquid, safer, and lower-yielding products such as term deposits without being penalised.

Deeming rate | Single | Couple | |

Lower threshold | 0.25% | ||

Upper threshold | 2.25% | >$60,400 | >$100,200 |

Financial assets are:

Savings accounts and term deposits.

Managed investments, loans, and debentures.

Listed shares and securities.

Some

Some gifts you make.

Currently, for a single person with $200,000 in assets, their deemed income would be $3,292 ($151 on the assets up to $60,400 and $3,141 on the $139,600 in assets above the threshold).

If this person had their $200,000 in a term deposit, such as the they would be earning 4.9%. That would mean their income was $9,800. Almost three times the income estimate from the current deeming rate.

Under superannuation, this same amount might return 7.1% giving an income of $14,200 – four times higher than the amount under the current deeming rate.

Deeming is clearly beneficial for part-pensioners (who come under the income test) because if it didn’t exist and these actual income amounts were taken into account, then they would receive a much lower pension.

For example: A single pensioner with $200,000 in deemed assets and $150,000 in assets that are not deemed (but giving a real return of 5%) would get a fortnightly pension worth $951 under the current deeming rules compared to $781 a fortnight if deeming didn’t apply and their true income was taken into account. They are $170 a fortnight better off thanks to the current low deeming rate.

With about 430,000 pensioners under the income test, that’s a lot of people better off under the current deeming rate.

The question for readers then is: Should the deeming freeze be lifted next year and if so, what do you think is a fair rate?